Back to Blog Home

How to collect payments from customers and clients

[Hide]

Send invoices with Copilot

Copilot gives entrepreneurs the tools they need to start, run, and grow their service business. Try it for free!

4.9 rating

Have you ever chased down an invoice?

We’ve all been there.

Late payments can disrupt your cash flow and impact your ability to meet financial obligations. But fear not!

I wrote this guide to equip you with the knowledge and tools to collect payments from customers efficiently and ensure you get paid on time, every time!

Whether you’re a freelancer, a small business owner, or a salesperson, this article is for you!

Let’s get started.

5 tips on how to collect payments from customers on time

I’ve encountered various clients during my entrepreneurial journey.

The best ones are those who pay upfront and never doubt the quality of your work, but such clients are rare.

If you are just starting an online business, get ready to work with various clients, including those who delay payments or don’t pay at all!

Why don’t customers pay?

There can be many different reasons:

- They might prioritize other bills

- Lack of funds to pay immediately

- Disagree with the pricing or deliverables

- Forget to make a payment

- Didn’t get your invoice for some reason

- Didn’t check the due date

- Etc.

In either case, you will be the one who doesn’t get paid on time, which can disrupt your cash flow.

In my experience, every client can be a good client when you set clear expectations upfront and keep them updated with the progress of your work.

I want to give you a few tips on how to bill a client for the first time and collect a payment from a customer on time without any issues. What took me years to learn, you can read below in a few minutes.

1. Build strong customer relationships

Strong customer relationships mean you and your clients are basically on the same page.

You treat them respectfully, they trust you’re doing a great job, and everyone feels comfortable communicating openly. It’s like having a good friend you can rely on—but for business!

Good customer relationships are critical to a smooth payment process.

Here’s why.

When your clients feel valued and informed, they, in turn, feel good about working with you and are more likely to pay on time.

Here’s what you can do to build strong customer relationships:

- Understand customer needs and values: Put yourself in their shoes to see and prioritize what matters most to them. These small gestures will leave a lasting impression.

- Communicate regularly: Keeping your clients updated on the progress of work is key to a successful collaboration, especially if you partner remotely. Use client platforms like Copilot to manage all customer-related tasks and promptly respond to your client’s messages.

- Offer personalized interactions: Does your client prefer calls over emails? Set up regular check-ins. If they can’t join a call for some reason, send summarized updates. Tailor your communication style to their needs.

- Actively listen to their feedback: Pay close attention to what your clients say and implement their feedback to ensure your work truly delivers what they need.

And my personal bonus tip — try to exceed your clients’ expectations!

Going the extra mile can help you leave a lasting impression and turn existing customers into loyal fans. This will directly benefit your business since word-of-mouth recommendations are one of the best client acquisition strategies.

All of these strategies will help you build trust so that on-time payments become the norm rather than the exception.

2. Set clear payment terms in advance

Imagine if a customer thought they had 60 days to pay when you actually expected payment within 30 days. This gap could create a cash flow crisis for you.

That’s why you have to specify the payment terms and expectations right from the beginning, which include:

- Explicitly stating the due date: This clarifies exactly when the full payment or each installment is expected.

- Amount owed: This outlines the total sum to be paid, including any applicable taxes or fees. Ensure to specify the right currency.

- Accepted payment methods: Options may include cash, check, credit card, debit card, bank transfer, online payment platforms, etc.

Besides setting clear payment terms, consider outlining late fees or penalties that should ensure you get paid what you’re owed on time.

I hope you’ll never have to refer to late payment terms and discuss it with your customers. However, this could potentially be your leverage to discourage delays.

In my experience, many businesses don’t explain the payment terms to their customers and jump straight to project details.

Don’t make this mistake!

Clear payment terms are an investment in the smooth running of your business. They prevent headaches, foster trust, and help ensure you get paid on time, every time.

3. Leverage automation

I encourage you to use automation to secure timely payments.

Rather than sending static PDF invoices and hoping your client remembers to pay them, you can leverage automation to collect payments from small businesses and big companies.

For instance, service business tools like Copilot allow you to create invoices, set payment due dates, and share them with customers instantly. As a result, this accelerates payment and removes delays associated with manual processes.

With Copilot, you can seamlessly embed online payment options directly into your invoices to let your clients pay instantly, whether they use their desktop or mobile devices.

You can preview the checkout page right when creating an invoice. This way, you can see exactly what your customers will experience when they open your invoice.

Like this:

Additionally, consider setting up automated email reminders that politely nudge your clients to pay your invoices.

With automation taking care of the repetitive and mundane tasks, you’ll have more time to focus on building positive relationships with your customers.

4. Use follow-ups

Not every payment delay is intentional.

Your client may have simply forgotten about their pending duty.

In this case, you could send a humble follow-up email to remind them about the payment delay.

For instance, Copilot has a built-in Messages App, which lets you send reminder messages to your clients right inside the dashboard. This triggers a two-way approach: your client will see a notification in their Copilot account and get an email.

I recommend re-attaching the invoice when sending the follow-up email. Keep the tone professional, but use this opportunity to politely remind your clients of the payment terms outlined in your contract.

However, if you don’t receive a response after the follow-up email, consider calling them for a more direct conversation.

5. Offer multiple payment methods

Imagine your customer reaches the checkout stage and discovers that their preferred payment method isn’t available. Disappointment sets in. In this case, they might abandon the checkout page, which will cause a payment delay.

Who wants this hassle?

No one!

You can remove this hurdle and make the payment process smoother by offering multiple payment options.

For example, you could offer payments using credit cards, debit cards, digital wallets (like Apple Pay or Google Pay), and ACH bank transfers.

The more options you have, the smoother the checkout experience becomes.

Ensure you are transparent about accepted payment methods and your payment terms from the very beginning. You could include this information on your website, invoices, and during the checkout process. This helps avoid confusion for your customers and ensures they know what to do next.

For instance, Copilot’s Billing App offers multiple payment options to help businesses and freelancers collect payments from their customers, including:

- Credit card

- Debit card

- Payments via ACH (only supported for USD)

Moreover, Copilot gives you the flexibility to decide who’ll pay the transaction fees. If you pass them on to your client, they will be responsible for all extra charges, which can be pretty high depending on your billing amount.

So far, I’ve only briefly touched on how to collect payments from customers online using Copilot.

If you want to streamline your business operations, save time, reduce human error, and create exceptional client experiences, here’s how you can achieve it with Copilot.

How to easily collect customer payments with Copilot

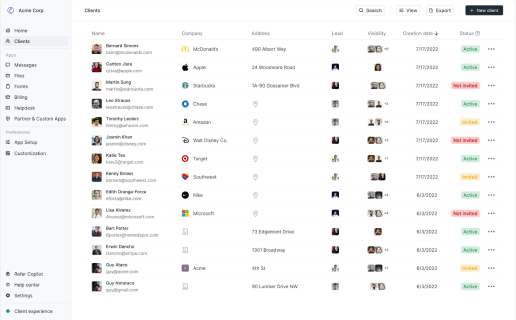

Copilot is a service business client portal that lets you communicate with your clients, share files, deliver services, and get paid — all in one place!

With Copilot’s Billing App, you can create branded invoices and subscriptions and make it easy to collect payments from your customers.

Here’s a quick guide to creating an invoice with Copilot:

- Navigate to the “Billing” section in your Copilot dashboard

- Click on “Create New Invoice”

- Select or add the client you are invoicing

- Add your product/service description

- Specify the payment amount

- Customize the invoice with your logo and brand colors

- Decide on the payment due date

- Choose how you want to let your client pay

- Decide who covers any transaction fees (you can pass them on to your client)

- Enable recurring payments if you offer subscriptions

- Review the invoice for accuracy and send it directly to your client via Copilot

Don’t worry, it’s easier than it seems! For a visual walkthrough of Copilot’s billing features, check out this video:

There are three invoice statuses you might see in your Copilot dashboard:

Open: This means the invoice has been created but not paid yet. Use the tips from this article to turn open invoices into paid ones.

Paid: Great news! Your client has paid the invoice.

Void: You cancelled the invoice.

It’s worth mentioning that Copilot uses Stripe to process your payments and send them to your bank account.

Navigate to “Setting” and the “Payout account” to connect your bank account before creating and sharing your invoice with your clients.

Alright, you are good to go!

However, you can take a few optional steps to improve your client dashboard.

With Copilot, you can also connect your accounting software, like QuickBooks, to manage administrative tasks, such as bookkeeping and taxes. This will make your life a lot easier during tax season.

Here’s how to integrate QuickBooks in Copilot:

- Navigate to “App Setup” and click “+ Add an app” in the top right corner.

- Scroll down the list of applications and select “QuickBooks.”

- Enter your credentials to log in to QuickBooks.

- Once you log in, you’ll see a confirmation message, which indicates a successful integration.

All done! Your client invoices and payments are now automatically synced with your accounting software, keeping your finances organized and saving you stress come tax time.

For more details, check out our QuickBooks App integration guide.

What if nothing works?

If you’ve tried all the above-mentioned tips but nothing worked, there are a few more ways to recover payments from unresponsive clients:

- Arbitration: A neutral third party reviews the situation and delivers a binding decision. This can be faster and less expensive than a lawsuit, but both parties must participate.

- Collections agencies: They specialize in collecting outstanding debts. They’ll take over communication with your client and attempt to recover the funds for a percentage of the amount collected. This option frees you from further interaction but comes at a cost.

- Lawsuits: This involves filing a lawsuit that forces your client to respond in court.

Each of these methods involves financial investment, waste of time, and frustration. Carefully consider any of these options as your last resort, as suing will likely burn bridges with the client.

Streamline your payment collection with Copilot

Running a business, especially solo, online requires juggling many tasks.

A well-defined and systematic billing process, covering everything from initial proposals to final branded invoices and gentle payment reminders, is essential for successful client interactions.

You can streamline the payment processes with the right tools!

With Copilot, you can collect payments from customers quickly and easily, onboard new clients, create contracts, share files, send messages and more— all in one client portal!

That’s why I happily use Copilot to manage my clients’ work.

If you are looking for easy-to-use software to invoice your clients, register for a 14-day trial (no credit card required) and try Copilot for free!

Share this post

Sign up for our newsletter

Subscribe to our newsletter to receive emails about important announcements, product updates, and guides relevant to your industry.