Payment processing can be intimidating for small business owners who may not be familiar with the steps involved or its jargon. With a global pandemic that further pushed contact-free transactions, online credit card payments are growing in popularity. From recurring revenue models to more traditional ecommerce, contact-free payments are seen more and more commonly across industries, potentially even among your competitors. Getting on top of the trend before it is too late is crucial to keeping up with other businesses.

While credit card fees may be intimidating, the sales boost your company might get as a benefit of adding cards as a payment method often outweighs the costs. There are even credit card processing companies that use a monthly fee model in combination with a smaller transaction fee to save high-volume businesses money. As you decide what processing service you want to use so that your customers can use credit cards to purchase your services or check out their shopping carts, it can help to learn about the process to make an educated decision.

What You Need to Collect Online Payments

Online credit and debit card payments are processed uniquely through a secure, encrypted communication service. Some payment processors like Paypal provide a complete package that includes a payment gateway because both are required in one way or another for online credit card processing. Knowing your payment gateway is essential in ensuring that your company stays Payment Card Industry Data Security Standard (PCI-DSS) compliant, something required if you plan to accept online credit card payments.

Payment Gateway

Payment gateways act as a secure way to gather a buyer's credit card information and encrypt it, preventing fraud and information leaks. These gateways act as a considerable security measure to prevent credit card fraud. Once all of this data has been converted into a secure format, it is sent along to the payment processor's next step in the process.

Payment processor

A payment processor helps send information between your merchant credit card processing service, the gateway, the credit card network, and the bank. These groups act to make sure your business bank account is given the proper funds, letting you know if there are any authorization issues along the way.

Merchant Account Providers or Payment Service Providers?

There are many differences between merchant account providers and payment service providers, which can be very confusing to new business owners. These terms describe two provider types that help you accept online payments in two similar but different ways.

Merchant Account Providers: Pros & Cons

A merchant services provider gives you your own separate account and merchant identification number (MID). After signing on with a merchant account, you can accept credit and debit card payments. However, only large providers also provide you with processing services through credit card networks.

Pros:

- Much higher limits

- You can negotiate prices with different credit card companies

- You can often customize prices of merchant services to your business

- Processing volume and transaction size limits can often be flexible and negotiated

- Overall customizable to your businesses needs

- Rather than being immediately frozen in the case of fraud detection, merchants are usually notified of the suspicious activity first

Cons:

- Verification takes much longer, sometimes weeks, to ensure that your company is trustworthy and compliant

- There is a higher barrier to entry, meaning if your company has a poor credit history or other background information that seems risky, you may be turned away by merchant providers

- Sometimes longer-term contracts are involved, meaning you may have to wait to switch providers if you find a better deal elsewhere

Payment Service Providers: Pros & Cons

You probably have interacted with a payment service provider (PSP), such as commonly seen providers Paypal or Square. Instead of having your own dedicated merchant account and MID, you have a merchant account aggregated with other merchants under the payment service provider.

Pros:

- Often instant verification and approval, make an account, and follow pre-requisite agreements. You don't have to go to a bank or fill out paperwork in person.

- Processing fees are usually low and are often predictable.

- There are usually no long-term contracts involved, meaning you can switch providers to save money whenever convenient.

- PSPs are regulated, having to have an RBI license and be compliant with PCI-DSS.

- The price point is often best when processing higher volumes and smaller transactions, which is great for some businesses.

Cons:

- Pricing is usually fixed

- Account holds are more at ease with PSPs since they are held to a high-security standard. Chargebacks can get you in trouble quickly due to the immediate payment processing

- There are limits on your processing volume and your transaction sizes, often which are pretty low

- PSPs technically can float your money for up to 30 days, and while you will usually get your money in less than five days, you could run into delayed funds

- Not very customizable

The Costs of Accepting Credit Card Payments

A handful of costs are associated with credit card payments, including processing fees, interchange fees, and PCI compliance fees. Here are some of the expenses that you should be conscious of as you make a move to accepting credit card payments:

Hardware Investment (On-Site Cost Only)

Setup fees for on-site payment function a bit differently than online-only payments. Brick-and-mortar retail payment platforms use terminals, POS systems, and credit card readers rather than virtual credit card processors. You may also consider implementing mobile credit card readers that work with smartphones and tablets rather than a completely separate POS system. Consider which credit card providers you want to accept, such as Visa, Discover, Mastercard, or American Express. Also, when picking the best credit card processor and POS for you, think about if you will be processing chip cards, contactless cards, or gift cards.

Monthly Subscription Fee

Some payment processing companies require a monthly subscription fee to use their services and interfaces. This option can be great for company models that don't work well with individual transaction fees and prefer a more predictable, flat rate for their processing. Often these monthly fees can be pretty high, but take the time to calculate out what transaction fees may cost you from other mainstream companies, and you may be surprised to find how much money you would save in the long run!

Individual Transaction Fees

Many different payment providers will have individual transaction fees per transaction paid with a credit or debit card. For example, Square charges 2.6% + 10¢ per payment through their Square Register system. On top of this, any credit card entered using Square's Virtual Terminal has a 3.5% + 15¢ fee. These charges can certainly add up over time and hurt companies that thrive on lower-priced but higher-volume transaction models.

Benefits of Accepting Credit Cards

Accepting credit cards has many benefits for your company, from improving your customer experience to becoming more accessible for a wider audience. Here are a few reasons why you should consider accepting credit cards:

Keep Up With The Competition

More and more companies are accepting credit card payments to keep up with demand. Not offering this popular payment method will make it much harder for you to compete with your competitors, especially if it is significantly more accessible for clients to make payments through their system. If your competitors aren't using online credit card payments already, they will be soon as more card use continues. The Federal Reserve Bank of San Francisco found that in-person payments were down to 72% in 2020 from 91% in 2019. On top of that, cards were used 55% of the time, with cash being used 19% of the time.

Lower Risk

While credit card fraud does occur, it is a much more secure payment method than many others, such as checks or cash. Credit card payments allow for an easy-to-track trail automatically updated as soon as payments are processed. Both checks and cash can be easily lost in the mail, stolen, or incorrectly tracked, leading to more liability for your company.

Build Customer Trust

Companies that accept credit cards are seen as more legitimate than completely cash-based businesses. Displaying that you process secure credit card payments can help customers feel more comfortable buying from you, especially when accepting payments online. In many industries, customers may shy away from businesses that don't accept card payments, concerned that they won't be able to dispute the transaction if they are scammed or something goes awry.

Improve the Customer Experience

Credit cards help facilitate quick checkouts, easy payments, and no-fuss payment processes. Customers can even save their credit card data for future purchases through some providers to make checkouts extremely quick. Not only does this ease allow for impulse buys (and higher sales), but it helps customers have a better experience, making them more likely to come back to your store for future purchases. If a customer has to jump through hoops to give you their money, they will be much less willing to pick you in the future for their shopping or services.

Industry-Leading Payment Processors

There are many payment processors out that you can consider as you start your research. Think about whether it makes more sense for your company to make payments per transaction or if a monthly subscription model makes more sense for how you operate. To get you started, here are a few processors that stick out as industry-leading companies of which you may have heard.

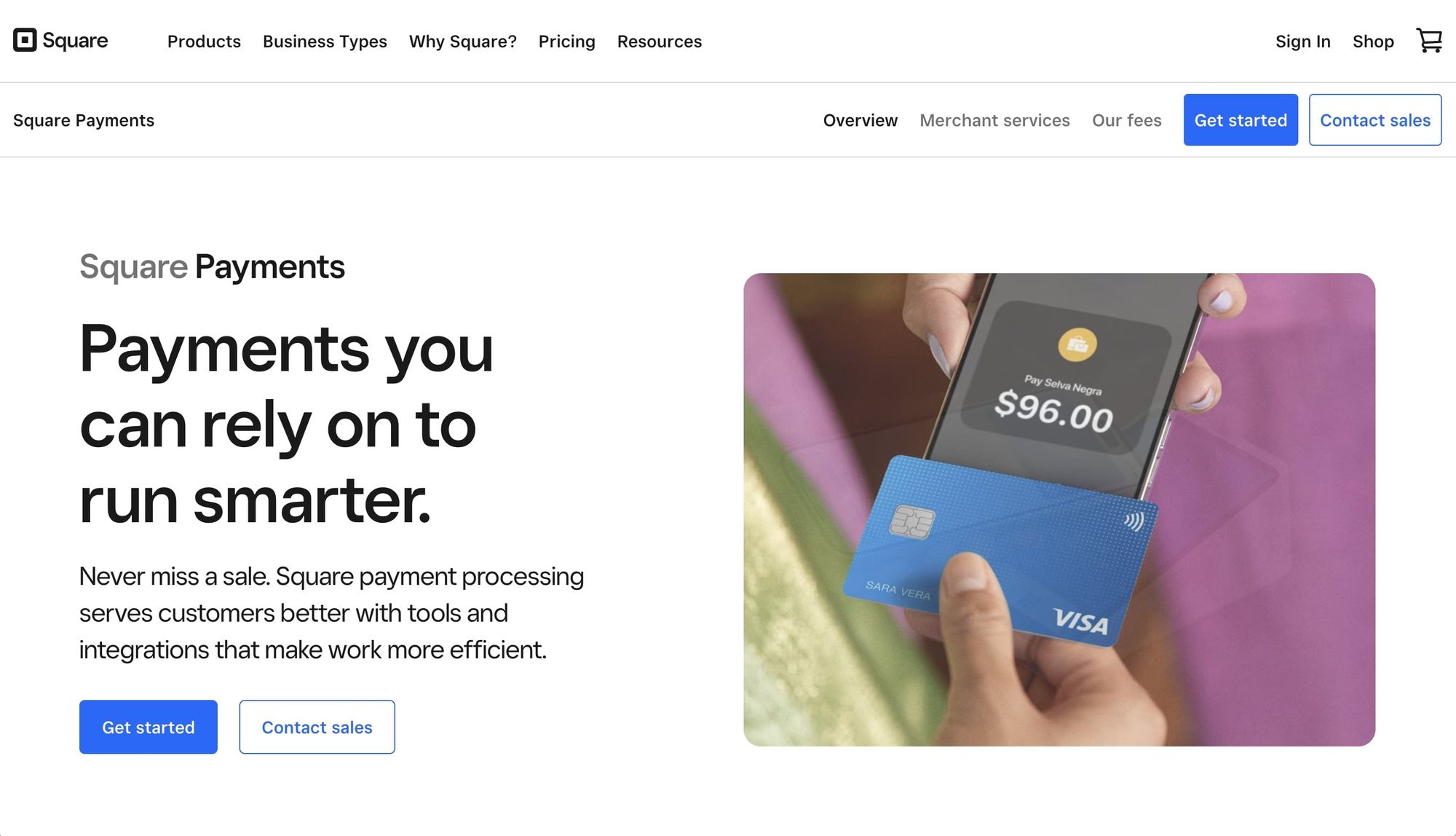

Square

Most people have interacted with a Square reader before, as the company is found in independent coffee shops and stores across the nation. Extremely accessible and easy to use, Square has become a popular pick, especially with companies needing a physical POS and card reading system. As previously mentioned, Square charges 2.6% + 10¢ per payment through Square Register. Using Square Online through eCommerce APIs, Online Checkouts, or Invoicing through Square costs 2.9% +30¢ or 1% with a minimum of $1 per transaction for ACH bank transfers. If you use Square's Virtual Terminal, it has a 3.5% + 15¢ fee.

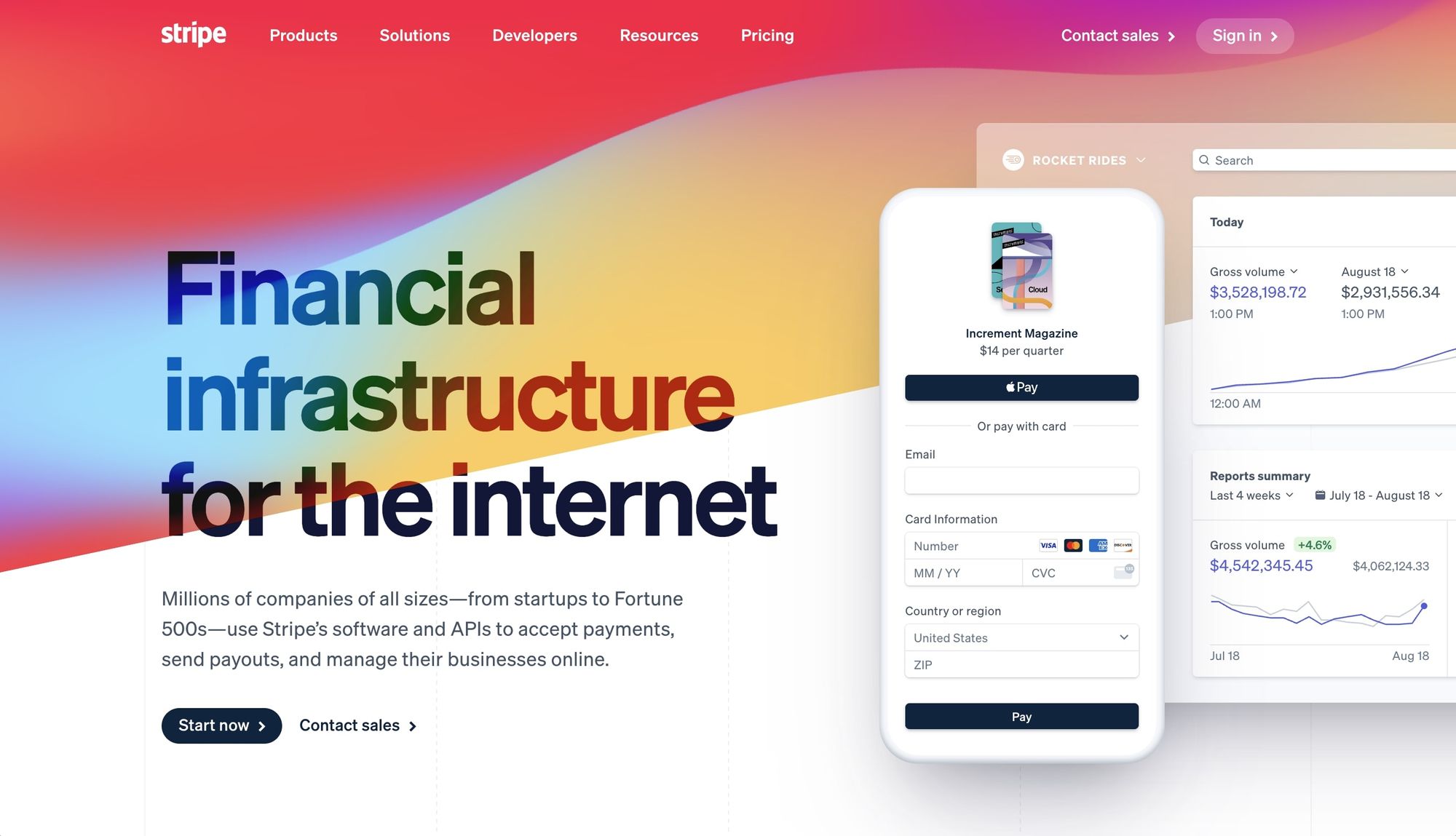

Stripe

Stripe is another well-known payment processor known for its API and flexibility. While they have customized packages for companies with large payment volumes or unique business models, they also have a fully integrated pickup and go platform, which costs 2.9% +30¢ per successful card charge.

Payment Depot

Unique from these other payment processors, Payment Depot, has a membership-style payment processing plan that makes charges more predictable for high-volume businesses. Their starter membership starts at $79/month with 15¢ per transaction and interchange. This initial plan lets you process up to $50,000/month. They also have a Most Popular and Enterprise membership, priced at $99/month and $199/month, respectively, both with significantly higher processing limits, lower per-transaction costs, and other features such as a dedicated account manager and breach protection.

Conclusion

Allowing your clients to pay with a credit card can improve their relationship with you and prevent you from having to chase after overdue payments. As the world moves towards more and more contactless payment methods, get ahead of the curve by taking credit card payments from your buyers and clients. There are many options for big or small business credit card processing that will be convenient for you and can help you elevate your customer experience by providing a secure payment method that your client is familiar with.

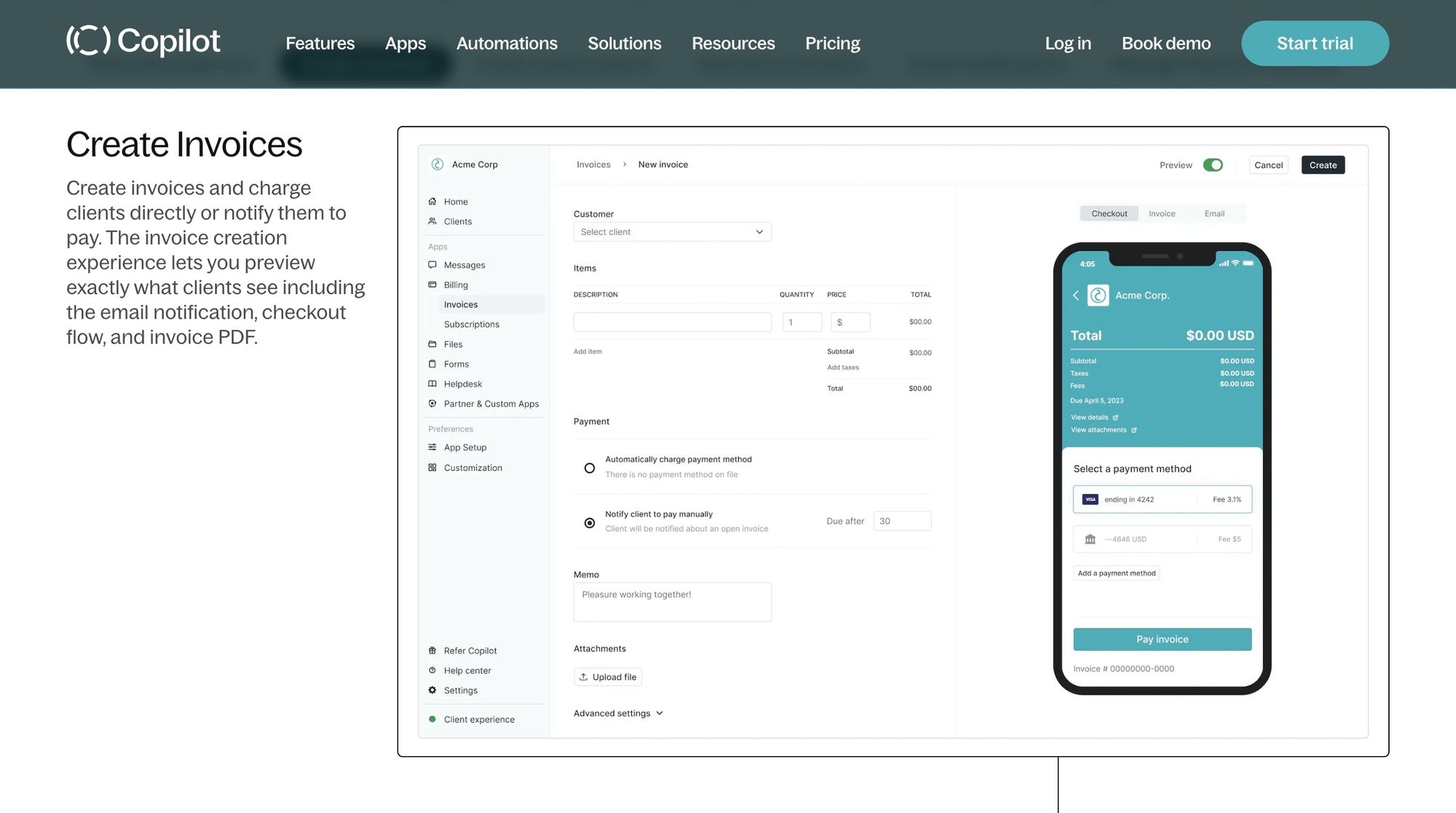

Streamline Client Invoice Collection

Copilot is a no-code customer portal solution that lets you offer clients a unified hub for messaging, file-sharing, eSignatures, payments, forms, and self-serve support. Copilot enables you to design a customized client experience that elevates your brand in all customer interactions. Try Copilot for free.

Share this post

Sign up for our newsletter

Subscribe to our newsletter to receive emails about important announcements, product updates, and guides relevant to your industry.