[Hide]

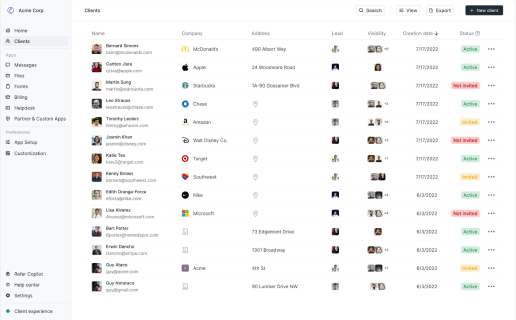

Bookkeepers run on Copilot

Differentiate your bookkeeping business with white-label portal that gives your clients a one-stop shop to access dashboards, submit tickets, send messages, make payments, and more.

4.9 rating

Managing people’s money means dealing with their livelihoods. You should not take it lightly.

Your clients trust you with their financial health, and they expect you to be there for them. And that can sometimes feel like a lot of pressure.

What happens when a client demands more than what was agreed upon? Or fails to pay you on time? Or worse, a breach of sensitive financial data occurs on either party?

Without a legally sound bookkeeping contract, you’re leaving yourself vulnerable to not just scope creep but legal obligations.

To help you avoid any issues when offering your services, we put together five bookkeeping contract templates that are vetted and offered by different trusted providers. We’ll also go over what you should include in your bookkeeping contracts so you can make sure any template you use follows all the proper guidelines.

Alright, let’s get started.

What to include in a bookkeeping contract

Knowing what to include in your bookkeeping contract is your foundation. It’s going to help you not only choose the right template for your services, but it will also help you review and analyze contracts your clients may send for you to sign.

A solid and well-written contract is going to outline: who’s involved, what services are included, confidentiality, how you’re going to get paid, and how to handle disputes or terminations.

Let’s go over each of these.

Parties involved

First is knowing who’s involved in a project. Aka, this part should be you stating all parties involved in the contract agreement. This is mainly going to come down to two parties:

- You, the bookkeeping service provider.

- Your client, the person or business receiving your services.

Depending on who your target client is, a person or a business, you’re going to want to make sure that whoever signing the contract actually has the authority to enter into an agreement. This is going to matter a lot if you’re working with a business — so make sure you know the person signing is the right person on the company’s behalf.

This part is simple, but being super clear at the start about who this contract applies to is important once you start working on a project. When you’re dealing with money (aka people's livelihoods) you want to be extremely careful and diligent about your bookkeeping contracts.

Scope of work

Once you know who’s involved, you need to state what you’re going to do for them. This section of your contract will define the exact bookkeeping services you’re going to provide. You want this part to be as detailed as possible so you don’t get into scope creep or any misunderstandings on what type of work (and how much) you will be doing.

Here are some general bookkeeping services that professionals include:

- Reconciling bank and credit card statements

- Recording and categorizing financial transactions

- Creating monthly financial reports (profit and loss, cash flow, or balance sheet)

- Accounts payable tracking

- Payroll processing and tax estimations

- Sales tax reporting and filing

It’s also a good idea to be clear on what service you will not provide. I know this because I personally use different services for reconciling bank statements and tax filing. Sometimes, you may offer these services together and clients might be expecting that. So just be clear.

Deliverables and deadlines

Next up is the what and when of your services. The scope of work goes over the what in detail, but this part will explain further the exact deliverables. The deadline will also mention when those deliverables are to be expected.

Here’s an example of what you should include in this section:

- Weekly deliverables: Here you want to explain what you will track in a specific accounting software.

- Monthly deliverables: Here you want to explain any monthly reports that would be generated. This could also include you filing sales tax reports.

- Quarterly deliverables: This would include things like financial summaries and coordinating with a CPA for tax preparation.

- Annual deliverables: This could include annual reports, preparation of tax statements, and help with tax filing.

For this entire section, you want to be clear about exact deadlines. You also need to mention the response times. As in, how fast your client needs to respond to any requested documents (this can be something like “X business days upon request”).

If you anticipate holidays or any delays, you also want to mention that deadlines may be adjusted for national holidays or unforeseen circumstances with prior notice.

You also want to make sure that you overestimate how long it will take you to finish a project (of course don’t go past tax deadlines). But it’s better to give your clients what they need earlier than expected. You don’t want to be in a position where you underestimate how long it will take you to do something and then be late on your deliverables — it will hurt your client retention in the long run.

Confidentiality and security

Next up is something that’s extremely important when dealing with money — security and confidentiality.

As a bookkeeper, it is your responsibility to make sure your clients feel safe. You have access to very sensitive information, including payroll records, bank statements, and tax documents. These are to be guarded and kept close to you and your client. So, you want to have some confidentiality terms to protect both you and your clients.

Here’s an example of what you could include in this section:

- NDA: You can have a non-disclosure agreement section where all parties involved agree not to share or disclose any information that is being exchanged during your contract (or even after it ends).

- Compliance with industry standards: When working with businesses, you can mention compliance with things like SOC 2, GDPR, IRS regulation, or other security laws in your (and your client’s) location.

- Secure file and data sharing: Here you want to define how you’re going to protect login information, financial reports, and sensitive documents. If you’re using Copilot, you can have peace of mind knowing all documents you or your clients upload in the Files App are secure and safe.

- What happens in a breach: Here you can outline the process of what will happen in case there is a data breach or unauthorized access to any sensitive information.

Ideally, your client gives you access to sensitive information in a third-party bookkeeping software and client portal tool. This way those platforms are responsible for many of the security parts of your services. For example, a lot of bookkeepers use QuickBooks or Xero for the bookkeeping part of things and Copilot for client management and file storage part of things.

As a reminder, Copilot or I are not responsible for what you do after reading any of Copilot’s blog posts. Please consult with a local lawyer or professional about your contracts.

Payment terms

Next up is my favorite — getting paid.

This part of your bookkeeping contract makes sure both you and your client are on the same page about how much your services will cost, when payments are due, and what happens if a payment is not paid or is late.

Here’s an example of what you could include in your payment terms section:

- Pricing packages: Here you will explain if you charge based on a monthly fee, hourly rate, or per-project basis. You can check out this article I wrote on creating different bookkeeping pricing packages.

- Billing frequency: Here you want to say when your client will be charged. Is it on the first of the month, biweekly, or after a project is completed?

- Upfront deposits: Depending on your style of billing, you could take initial deposits or retainers from clients before you actually start working on a project for them.

- Payment methods: Here you want to list accepted forms of payment. Whether it’s bank transfers, credit cards, ACH transfers, or whatever else. Be sure to mention what you offer and what you prefer. You can also use Copilot’s Billing App to help with this entire process.

- Late fees: If clients fail to pay on time, you can mention if there are any late fees and what those fees are.

- Refund policy: Here you want to state if you offer any refunds. Be in partial refund or full refunds, list out what you offer and under what circumstances or conditions.

Make sure you’re clear on this part. After all, you disservice to get paid what you’re worth. So don’t rush this part.

Termination policy

Hopefully, you don’t have to deal with this part of your bookkeeping contract but always better to be safe than sorry. Having a clear termination clause in your contract lets all parties involved know how they can end a contract, how much notice is required, and what happens after termination.

Sometimes, you might deal with clients that simply suck. And other times, a client may want to stop using your services. Either way, you want to make it easy and headache-free for both parties. Even if you don’t anticipate (or want) a termination to happen, simply having this section gives your clients peace of mind and lets them trust you even more.

Here’s an example of what you could include here:

- A notice period: You want to list out how much time notice each party needs to give before the end of a contract. This could be something like 30 days before the next billing cycle.

- Final payment required: Here you can mention if there are any penalties or final payment requirements if a contract is to be ended early on your client's behalf. You can also have a refund policy here.

- Data transfer or access: Here you want to clearly mention how you will all hand off data smoothly, securely, and professionally.

- Breach of contract: Here you want to mention a valid response for immediate contract termination. For example, if invoices or payments are never received, failure to provide any necessary information, or any violation of confidential agreements.

Also, if you’re dealing with annual or long contracts, make sure you state if any and what early termination fees may apply.

Overall, once you know what should be included in your contracts, you can easily create a bookkeeping contract template that can be used (and edited) for all of your client interactions.

But, there are also tons of existing services out there that have ready-to-customize templates. And I’ve put together five of my favorite ones. Let’s go over them.

5 bookkeeping contract templates you can use in 2025

Here are five bookkeeping contract templates you can use:

- eForms bookkeeping contract

- PandaDoc’s bookkeeping contract

- Legal Template’s bookkeeping contract

- Bonsai’s bookkeeping contract

- CocoSign’s bookkeeping contract

Alright, let’s take a look at each one.

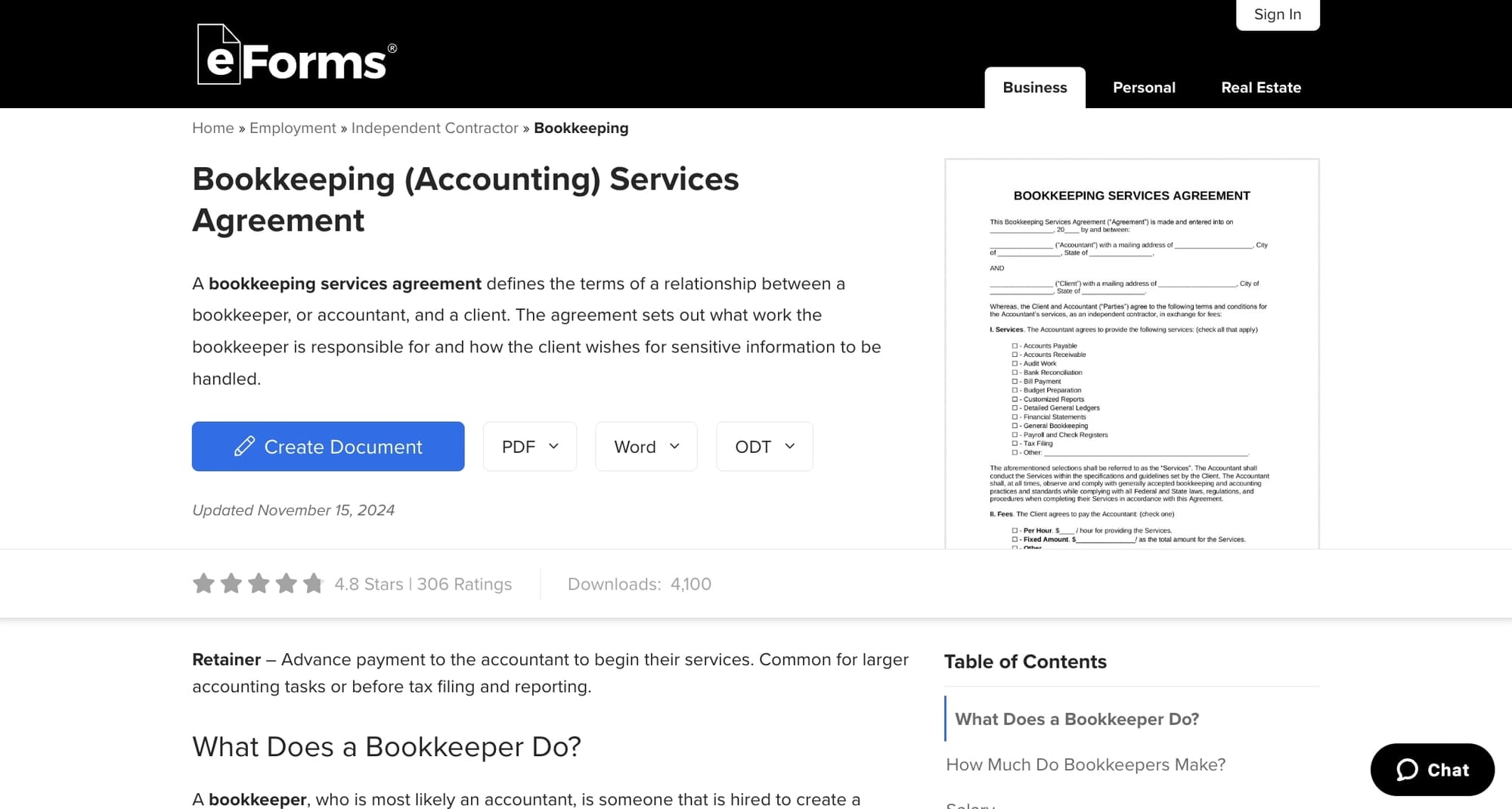

1. eForms bookkeeping contract

First up, we have eForms bookkeeping contract template. With a 4.8 out of 5 star rating, from over 306 reviews, this template is widely used by many accountants and bookkeepers (over 4,094 downloads so far).

It’s a great template for individual bookkeepers or accounting firms that want a simple and legally sound contract.

Here are some key features of this template:

- Legally vetted and has clear contract terms and conditions.

- Customizable for different client types and needs. Great for consultants, freelancers, and firms.

- Covers the essential contract elements we talked about in the earlier section of this article.

- Available in different forms like PDF, Word, or ODT.

Overall, this is a great general bookkeeping contract template to build on. However, you might want to add more specific terms related to your services (see the deliverable and deadlines part of the section we talked about earlier).

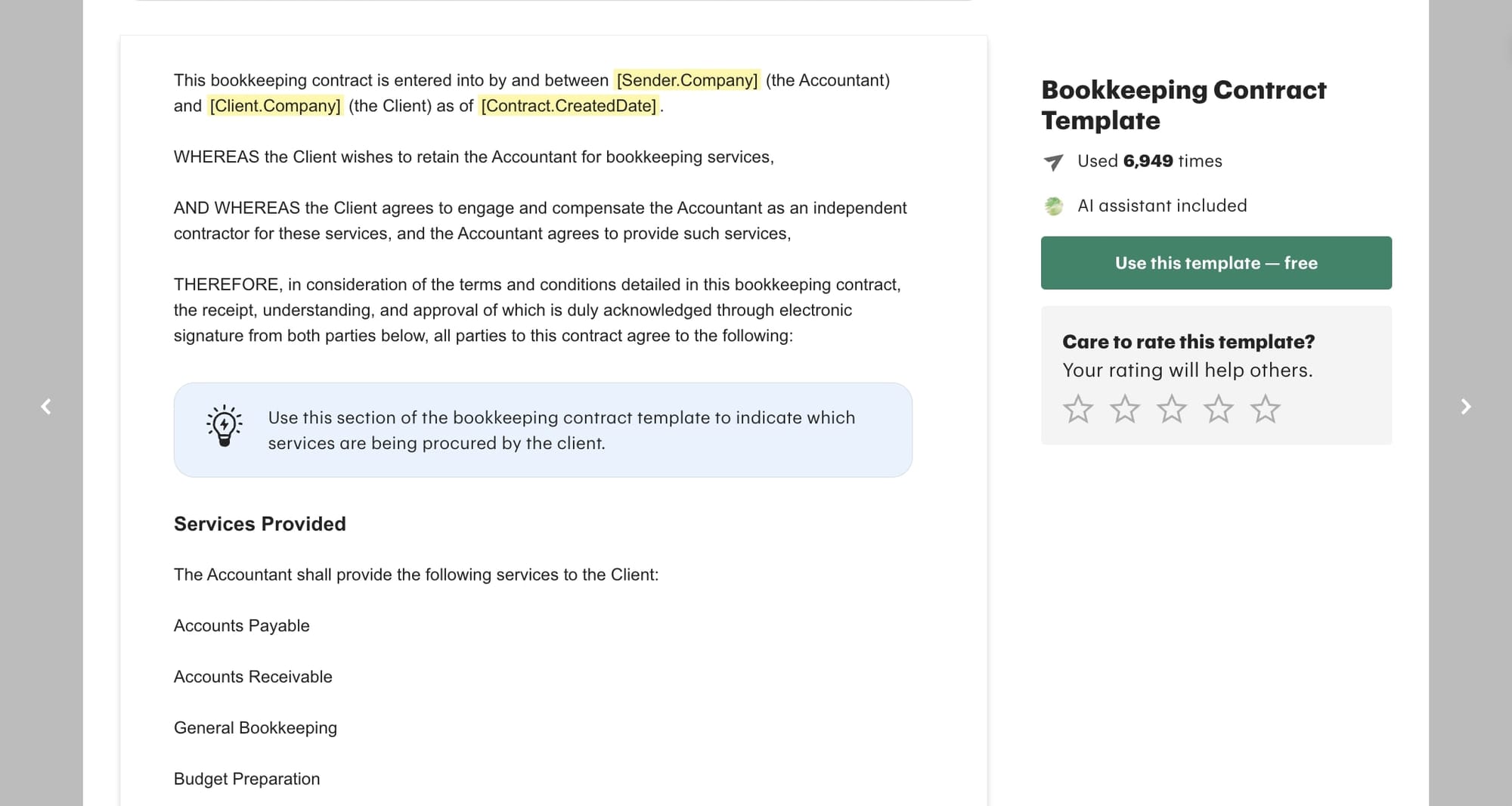

2. PandaDoc’s bookkeeping contract

Next up, we have PandaDoc’s bookkeeping contract template. I like this template because PandaDoc is well respected for following industry standards when it comes to their wide range of contract templates.

PandaDoc also makes it easy to customize their contract templates, so this is great if you want to build off of a general bookkeeping contract template (like the template we just went over).

Here are some key features of this template:

- E-signature and automation features are built-in so clients can sign the contract virtually. You can also do this with Copilot’s Contracts App.

- Has customizable sections for different types of services and payment options (like hourly rates, retainers, or monthly fees).

- Integrates with third-party accounting software like QuickBooks or Xero.

Overall, this template is best for bookkeepers dealing with multiple clients. It’s also best for accountants dealing with businesses over just individuals.

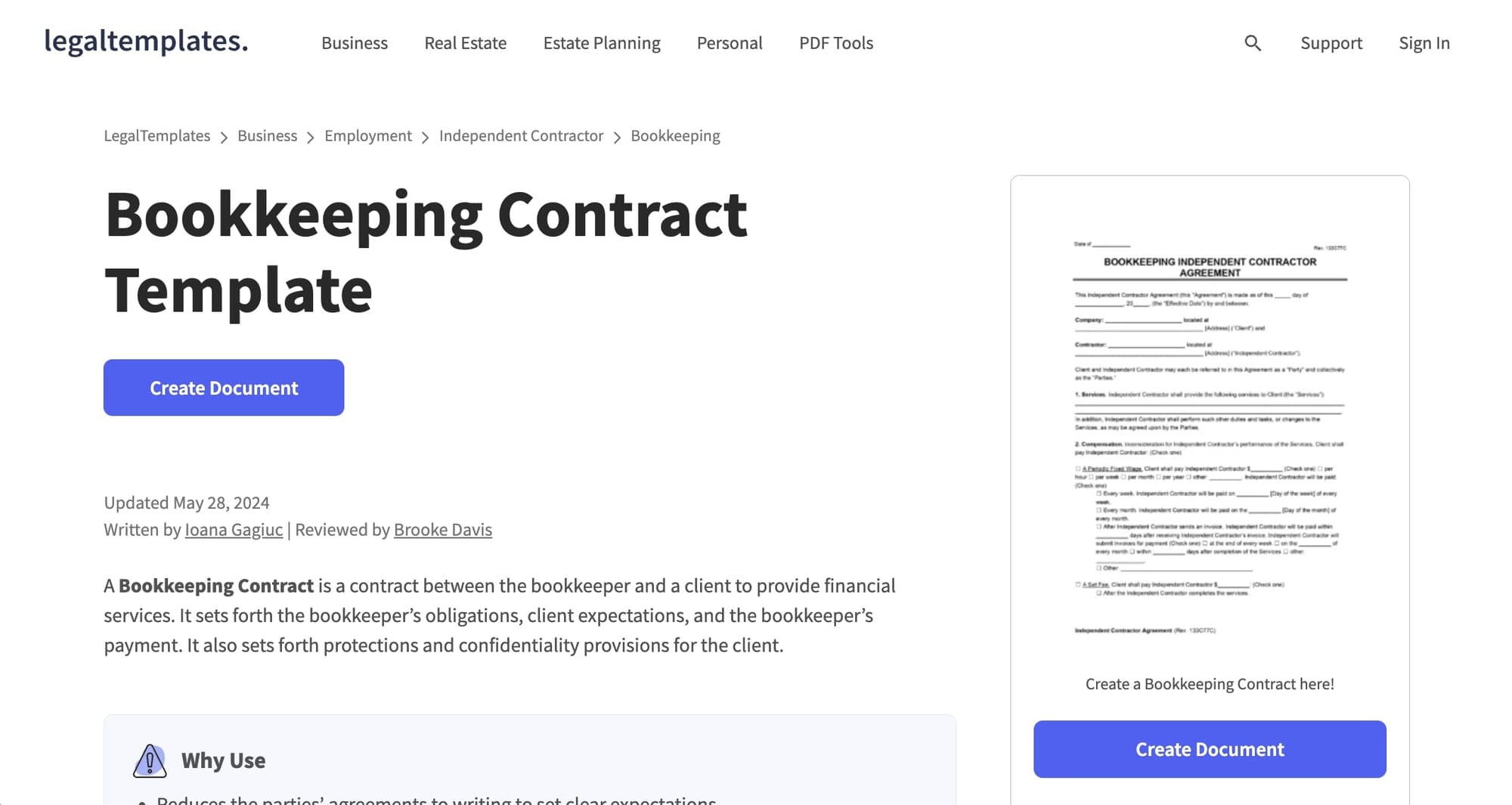

3. Legal Template’s bookkeeping contract

Up next is Legal Template’s bookkeeping contract. This template is best for independent contractors and smaller bookkeeping firms that want a simple and easy-to-use contract. It has a 4.7 out of 5-star rating, making it a solid choice.

Here are some of its key features:

- Follows best practices for bookkeeping agreements.

- Customizable contract builder for different services and client types — whether you’re working with individuals or small businesses.

- Covers key contract necessities like payment terms and confidentiality clauses.

- Available to download in multiple formats like PDF, Word, or print.

Overall, this is a solid contract. And it might even be one of my favorites on this list because of the customizable contract builder. Ideally, you use a tool like this and then download the contract as a PDF and upload it to an accounting client portal software like Copilot where your clients can access it and e-sign the contract.

4. Bonsai’s bookkeeping contract

One of my favorite contract templates for individuals and independent contractors has to go to Bonsai’s bookkeeping contract template. Bonsai is well-known for freelancers and smaller agencies. It’s actually the platform I started with to manage my clients before I switched over to Copilot.

Their bookkeeping contract template is great for solo bookkeepers just starting out or working with individuals.

Here are some key features of this template:

- Designed with simplicity for solo bookkeepers and smaller bookkeeping firms in mind.

- All-in-one client management platform that can handle more than just contracts.

- Legally vetted contracts that are also customizable to fit your specific services and pricing model.

Overall, Bonsai’s free contracts are great for when you’re a solo business owner just starting out.

5. CocoSign bookkeeping contract

Last but not least, we have a bookkeeping contract template from CocoSign. When you think of a simple and straightforward contract, this is one that comes to mind. Similar to PandaDoc, CocoSign is a document management platform for business owners. So, they have done their due diligence to make sure their contracts are legally sound.

Here are some key features of this contract:

- Legally sound to give you peace of mind when offering your bookkeeping services.

- Easily customizable to fit your services and pricing structure.

- Includes necessary sections like scope of work, payment terms, and confidentiality clauses.

Overall, CocoSign’s bookkeeping contract template is great if you’re dealing with multiple contracts and clients at a time. The platform helps you manage all of your contracts in one place and even has e-signature capabilities.

Run a modern bookkeeping business

Finding the right bookkeeping contract template is just the first step to running your bookkeeping business. Albeit an exciting step because it means you just signed a client!

But once a contract is signed, and the work begins, you’re left with other parts of your account business that need a lot of TLC (tender, love, and care). Things like giving your clients a dedicated portal to access (and upload) all of their files, view outstanding invoices, and communicate with you are all equally (if not more) important.

That’s where a dedicated accounting client portal platform like Copilot comes into play.

I’ve personally been using Copilot for over two years now. And its helped me with:

- Automating my client onboarding process.

- Uploading and signing contracts digitally.

- Create branded invoices with automated notifications.

- Create branded client portals my clients can log into.

- Integrate with existing third-party apps I use.

- Integrate messaging into one single platform.

If you want to see how Copilot works, play around with this demo:

And if you’re about your bookkeeping business, be sure to sign up for a free account and add your own services and clients to the platform.

Share this post

Sign up for our newsletter

Subscribe to our newsletter to receive emails about important announcements, product updates, and guides relevant to your industry.