[Hide]

Run your accounting business on Copilot

Copilot gives you the tools you need to start, run, and grow your client business. Try it for free!

4.9 rating

With the rise of AI (artificial intelligence), the world of accounting just got a little more exciting. There’s never been a better time to be a business owner in the AI era.

Accounting requires a lot of time, attention to detail, and precision. AI accounting software helps you become more efficient because it automates mundane tasks without causing human error. It’s the perfect choice for firms that want to scale because it increases throughput without making new hires.

So, what is the best AI accounting software out there today? Let’s find out.

What is AI accounting software?

AI accounting software is a set of tools that automate traditional accounting tasks by using a mix of artificial intelligence technologies, such as machine learning (ML), optical character recognition (OCR), and Natural Language Processing (NLP).

Some of the tasks that AI accounting software can help with are things like:

- Data entry

- Reconciliations

- Expense tracking

- Financial reports

- Fraud detection

- Accounts payable and receivables processing

- Preparing for audits

- Regulatory compliance updates

The most compelling argument for adopting AI accounting software is that it frees up accounting teams from mundane and repetitive jobs. Rather than replacing traditional accountants, this freedom allows employees to focus on value-driven tasks, like financial decision-making or providing strategic insights needed for growth.

AI accounting software is also an elegant solution for businesses that want to scale their operations. As you win more work and your AP and AR departments start heating up, AI-powered software can scale with you. No more stress; just accurate, compliant, and on-time accounts that give you the visibility you need to make data-driven decisions.

What to look for in AI accounting software?

Selecting the right AI accounting software comes down to understanding what you need.

Automation

Automation is the number one quality you need to look for in AI accounting software. At the root of leveraging AI in your business is the ability to automate repetitive tasks. Finding an AI accounting solution that includes automation features is key to fully leveraging this technology.

Client portals

Accounting teams need to communicate with not only their clients but also with each other internally. Finding an AI accounting solution that includes a client portal solution is key to creating a great team and client experience.

Client onboarding

Accounting departments need good onboarding functions to make sure they can quickly and accurately register new accounts.

Payment processing

Finally, accounting teams need user-friendly, secure payment processing to ensure healthy cash flow. Additionally, as subscription payment models continue to dominate, software that helps manage and process these inflows is invaluable.

10 best AI tools for accounting firms in 2024

Here are our top picks for the best AI accounting software:

Let’s take a deeper look at each of these.

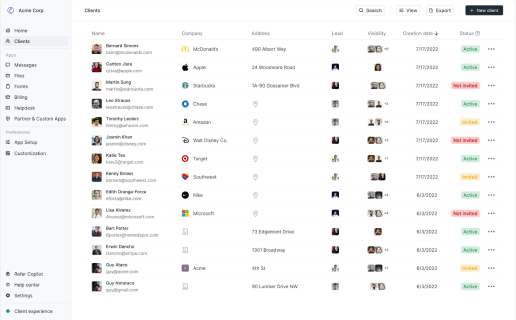

1. Copilot

- Best for: Small to large businesses that need a client portal and payment subscription options

Copilot is an all-in-one solution that helps teams communicate with clients, process payments, host contracts, and share important files. It’s a great choice for accounting teams because it provides a wide range of payment options, including subscriptions, and hosts contracts and files so you can stay connected with clients.

The Copilot portal is very user-friendly, which means onboarding and managing your clients is straightforward. The portal is highly customizable, allowing a seamless experience that stays consistent with your brand. What’s more, while you can integrate with popular accounting tools, you can also use custom apps that meet your specific needs.

Finally, Copilot integrates easily with other third-party tools.

Copilot notable features

Copilot is packed with features that help with accountancy processes. Let's explore some of the best.

- Excellent onboarding features that set your users up for success

- Digital contract signing features

- Superb integration with third-party accounting tools

- Superb portal to manage your clients and facilitate communication

Copilot pricing

Copilot offers different tiers based on the features and usage you need. Prices start from:

- Basic: $29 per month

- Professional: $69 per month

- Advanced: $119 per month

- Supersonic: Custom pricing

Copilot reviews

Copilot users have made their feelings known on review sites, including:

- G2: 4.8/5 — “Copilot is a quality accounting portal to meet our needs.”

- Capterra: 4.9/5 — “Portal makes the experience for our team and our clients really simple.”

- Product Hunt: 5/5 — “Modern, straightforward, yet extremely feature-rich.”

2. Vic.ai

- Best for: Teams who need to process high volumes of invoices

Vic.ai is a cloud-based software that brings artificial intelligence to Account Payables (AP). With a big focus on automation, it helps teams save a huge amount of time with processing invoices, and all the associated manual data entry.

VIc.ai uses Optical Character Recognition (OCR) tools to read and process invoices. The upside here is that invoice processing is both quicker and more accurate. Vic.ai also has excellent analytics tools that give real-time financial insights so you can stay on top of your spending patterns and vendor performance.

Finally, Vic.ai is very user-friendly and easy to implement. It also integrates well with other third-party tools, allowing you to overcome the fact that it’s not a complete accounting suite.

Vic.ai notable features

Vic.ai is packed with features for the AP team, including:

- OCR and ML technology that automates data gathering from invoices

- Excellent integration with other accounting tools

- Analytics dashboards that provide visibility and invoices into spending

- Automating tools to help categorize, approve, and process invoices

Vic.ai pricing

Vic.ai has two pricing tiers, which are:

- Accounting firms: $1,490 per month

- Enterprise: Custom pricing.

Both plans offer the same features, but the Enterprise option includes Open APIs, higher security, and Enterprise ERP integrations.

Vic.ai reviews

Copilot users have made their feelings known on review sites, including:

- G2: 4.8/5 — “Vic.ai is definitely one of the best AI platforms in the fintech space I’ve come across.”

- SaaSworthy: 4.8/5

- Trustburn: 4/5 — “ The platform's user-friendly interface makes it easy to navigate, and the accuracy of the AI is truly remarkable.”

3. Zeni

- Best for: Teams who want to streamline their accounting process

Zeni is an AI-powered accounting solution that aims to streamline and simplify the accounting process by automating traditional bookkeeping tasks and offering real-time visibility and insights into your finances.

Zeni is very user-friendly and scalable, and it delivers on its promise to help your business scale. However, it’s an expensive tool that lacks the customization and integration capabilities of rival tools. That said, the reporting features are great, making it suitable for businesses of every size.

Zeni notable features

Zeni has lots of features for modern accounting teams, including:

- AI-powered bookkeeping to reduce manual tasks

- Excellent reporting tools

- A customizable dashboard packed with real-time insights

- Useful tax preparation features

Zeni pricing

Zeni offers three different pricing tiers:

- Starter: $549 per month

- Growth: $799 per month

- Enterprise: Custom pricing

4. Trullion

- Best for Companies that need to track leases and comply with leasing regulations

Trullion is an AI-powered software specializing in lease accounting. Leases are challenging to manage for larger businesses, thanks to the evolution and complexity of lease accounting regulations. Trullion solves these issues by automating lease analysis, data entry, audits, reporting, and disclosures.

Streamlining workflows and manual labor, high levels of accuracy, and superb reporting and audit preparation tools are invaluable to businesses with a lot of leases. However, high costs and implementation complexity are slight drawbacks. Overall, this is a great tool for specific businesses.

Trullion notable features

Trullion has several great features for accounting teams, including:

- AI-contract analysis that reduces data entry while keeping teams up to date on leases

- Fantastic and detailed reporting tools

- Extracts data from contracts, invoices, CRMs, and databases to ensure accurate revenue recognition

Trullion pricing

Trullion does not offer a free version. Pricing starts at $3000 per year.

5. Booke AI

- Best for: Small businesses and accounts who want to boost productivity

Booke AI is a relatively new AI-powered accounting software. However, it is quickly gaining recognition thanks to its time-saving and accurate automation abilities.

Booke AI offers two different products. Their flagship product is Robotic Ai Bookkeeper, which integrates with QuickBooks and helps categorize your transactions. Users are prompted to approve unusual transactions, which teaches the AI and improves accuracy, which means Booke AI improves as you use it.

The other product is the Data Entry Automation Hub. This offers OCR AP automation, auto expense categorization, AI reconciliation support, and integration with QuickBooks, Zoho, and Xero.

Booke AI notable features

Some of Booke AI’s best features include:

- OCR data extraction

- Seamless integration with major accounting tools

- ChatGPT to read client emails and extract accounting data

Booke AI pricing

Booke Ai comes with two pricing tiers aimed at different levels of users:

- Data Entry Automation Hub: $20 per month

- Robotic AI Bookkeeper: $50 per month

6. Docyt

- Best for Bookkeepers and smaller accounting firms who want to embrace automation

Docyt is a cloud-based accounting software that streamlines financial management with a range of useful automation tools. It’s very user-friendly and comes with an excellent interface that makes automating bookkeeping tasks quick and intuitive.

Docyt also boasts strong collaboration features that help your team (or external accountants) work on your financials at the same time.

Reconciliation, expense management, tax support, and more can all be automated, which makes your firm more efficient and easy to scale. These features help overcome relatively high costs and a lack of customization.

Docyt notable features

Docyt has some great features for accounting, including:

- Excellent expense management and payment tools

- Strong revenue reconciliation features

- Tools to support month-end closing

- Great dashboards for real-time reporting

Docyt pricing

Docyt offers a flexible range of plans for different needs:

- Impact: $299 per month

- Advanced: $499 per month

- Advanced Plus: $799 per month

- Enterprise: $999 per month

- Accounting Firm & CFO Services: Custom pricing

7. Indy

- Best for: Freelancers and very small teams

As its name suggests, Indy is a business management tool focused on small independent businesses and freelancers. As part of its overall business offers, it has solid accounting tools that help with invoicing, sending proposals, generating contracts, and tracking expenses.

Indy is affordable, easy to use, and perfectly suited to small or solo operations. It’s not going to work for larger teams or anyone who needs complex financial reporting, but it's an ideal choice for small freelance businesses that want a smooth and streamlined customer experience and easy invoicing.

Indy notable features

- A project portal to make client communication simple

- Proposal, contracts, and forms to boost the client journey

- Integration with Zapier and Google Calendar

Indy pricing

Indy offers a limited free version, alongside a free 7-day trial, The Pro Bundle version starts at a bargain $9 per month.

8. Bonsai

- Best for: Service-based businesses with a focus on focus on proposals, contracts, and client management

Bonsai is another business management tool focused on freelancers and small businesses. While it is capable of much more, it comes with solid features for accounting professionals, bookkeepers, and CPAs.

Bonsai excels at automating accounting tasks, like invoice generation and syncing payments to QuickBooks Online. It also offers a great client portal, form and contract sharing, and solid onboarding features. While Bonsai is highly customizable, it offers users a huge range of templates for different accounting needs, including contracts, forms, proposals, invoices, and general bookkeeping.

However, while Bonsai has many great features, if you want a fully-fledged accounting solution, you need to integrate it with more complex tools. That said, it’s a very popular solution because it streamlines tax preparation and has good time-tracking features without compromising on user-friendliness.

Bonsai notable features

Bonsai has lots of interesting features for accounting teams, including:

- Customizable dashboards for account visibility

- Excellent project management tools that align with accounting and client management

- Integrated payment processing with PayPal and Stripe

Bonsai pricing

Bonsai comes with three different pricing tiers to suit different teams.

- Starter: $21 per month (+$10/month per additional user)

- Professional: $32 per month (+$10/month per additional user)

- Business: $66 per month (+$10/month per additional user)

9. Moxo

- Best for: Remote customer-facing teams who need to automate accounting and client management

Moxo isn’t accounting software in the truest sense. Instead, it’s a client communication platform that is built to help accountants manage and retain their clients. While you will require integration with your other accounting tools, Moxo will help deal with the other important stuff, like exchanging documents, electronic signatures, task management, and progress tracking.

By providing client portals and collaboration tools, Moxo is a centralized platform that helps accelerate a whole host of accounting processes, such as tax preparation, invoice tracking, bookkeeping, AP, inventory management, and a whole lot more.

Adding more users can quickly increase costs, while the steep learning curve is something to think about. However, if you have existing accounting tools and want to improve your client experience, Moxo is an excellent choice.

Moxo notable features

Moxo has some great customer-focused features, including:

- Excellent communication tools, like screen sharing and video hosting

- Solid customizable client portal with document sharing and e-signature capabilities

- Bank-grade security that makes it suitable for financial industry teams

Moxo pricing

Moxo’s doesn't publicly show their pricing on their website. If you want to learn more, you should schedule a demo with them.

10. Truewind

- Best for: Early or growth-stage startups who want solid accounting without adding headcount

Truewind is an AI-powered bookkeeping solution that is best suited to startups. It’s capable of powerful and accurate automation that reduces the time you spend on manual tasks and allows you to get back to running the other areas of your business.

The idea here is that instead of doing bookkeeping yourself, you outsource them to Truewind’s combination of AI and certified accountants. This helps you close your books with speed and accuracy.

However, perhaps Truewind’s best qualities are its financial modeling and real-time insight capabilities. These features are particularly suited to startups that need to make decisions backed up by solid data, which is what is needed when you want to grow and scale sustainably.

Truewind notable features

Truewind is full of great features that will suit startups with their accounts, including:

- Sophisticated financial modeling tools

- Access to a team of accounting experts for questions and advice

- Seamless integration with a range of business tools and payment processors

Truewind pricing

Truewind offers pricing based on customer quotes. However, at minimum, this accounting tool starts at $249 per month.

Conclusion

Accounting is complex, time-consuming, and vulnerable to human error. Thankfully, there are lots of AI accounting software tools on the market that were built to solve these issues.

While automating financial processes like AP is a great start, if you really want to scale your firm, you need to think about client management.

Tools like Copilot were built to deliver excellent client experiences, from proposals to contract offers to onboarding.

As the mechanical aspects of accounting become automated, it’s the client-focused elements that can set your team apart. Copilot helps you deliver outstanding onboarding and client management, which means you can focus on delivering value to your clients and the C-suite.

Share this post

Sign up for our newsletter

Subscribe to our newsletter to receive emails about important announcements, product updates, and guides relevant to your industry.